If you’ve ever juggled multiple credit card bills, personal loans, or even medical debts, you know how stressful it feels. Debt consolidation can be the reset button. Instead of paying five or six lenders each month, you roll everything into one loan with a single due date. That’s the promise behind traceloans.com debt consolidation, a service that matches borrowers with lenders who offer simplified repayment options.

Here’s the reality, the global debt consolidation market topped $20 billion in 2024 (Verified Market Reports), and experts like Bernadette Joy (founder of Crush Your Money Goals) stress that consolidation “isn’t a magic fix, but it can simplify payments and lower interest if done wisely.” Add to that the fact that 45% of Americans carry credit card debt (Forbes Advisor), and it’s clear why more people are searching for reliable solutions.

Instant Answer

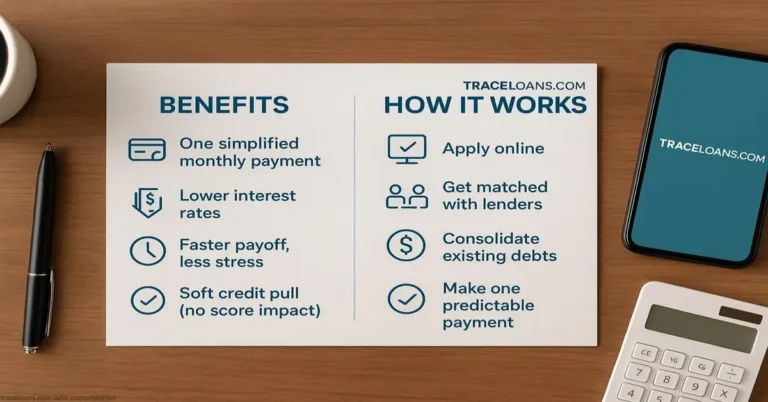

Traceloans.com debt consolidation combines multiple debts into one loan with a single monthly payment, often at lower interest rates. The platform doesn’t lend directly but connects you with a network of lenders, typically delivering pre-approval decisions within 48 hours. This makes it easier to manage money, reduce financial stress, and work toward becoming debt-free faster.

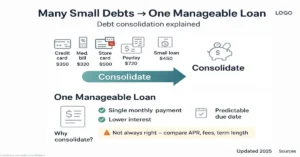

What is Debt Consolidation & How Can Traceloans.com Help?

Debt consolidation means combining many debts into one new loan. The benefits are simple: fewer bills to track, possible savings on interest, and a set payoff plan.

How Traceloans.com fits in:

- Acts as a loan-matching service, not a direct lender.

- Uses a network of lenders to compare offers quickly.

- Provides pre-approval decisions within hours and funding in under 48 hours.

- Covers multiple debt types: credit cards, payday loans, personal loans, and even medical bills.

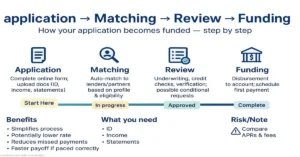

How the Traceloans.com Process Works

The process is straightforward, and it’s designed to be transparent. With traceloans.com debt consolidation, you move through four simple steps:

- Online Application & Soft Credit Check: Quick form, no initial hard hit on your credit.

- Algorithm Matching: The platform pairs you with lenders that fit your profile.

- Review Loan Offers: Compare terms, APR, and fees side by side.

- Accept & Receive Funds: Choose your best option and get funds in a few days.

Evaluating If a Traceloans.com Consolidation Loan is Right For You

Not every borrower should jump in without reflection. Here’s a simple self-check.

Pros:

- One easy payment each month.

- Potential for lower APR than credit cards.

- Clear payoff date.

Cons:

- Some lenders may charge origination or hidden fees.

- A longer term could mean paying more in total interest.

- Requires discipline missed payments can undo progress.

Fine print to check carefully:

- Origination fees (typically 1–8%).

- Prepayment penalties.

- Variable interest rates that may increase.

Myth vs. Fact: Common Debt Consolidation Misconceptions

- Myth: It destroys your credit.

Fact: There’s often a small dip, but consistent payments can actually improve scores (M&T Bank). - Myth: It erases debt.

Fact: You still owe the structure just changes (Alleviate Financial). - Myth: Only irresponsible people consolidate.

Fact: Smart borrowers use traceloans.com debt consolidation as a tool to manage debt efficiently (Attorney Debt Fighters).

Traceloans.com vs. The Competition: A Clear Comparison

See how does traceloans.com debt consolidation stack up against other popular options?

| Feature | Traceloans.com | Balance Transfer Card | Debt Management Plan | Direct Lender |

| Best For | Comparing multiple offers quickly | Borrowers with excellent credit | Those struggling with payments | Loyal bank customers |

| Speed | Hours–Days | Weeks | Weeks | Days |

| Credit Impact | Hard inquiry | Hard inquiry | Varies | Hard inquiry |

| Fees | Varies by lender | 3–5% transfer fee | Setup + monthly fees | Possible origination fees |

Your Step-by-Step Guide to Applying with Traceloans.com

Want to maximize approval chances? Follow this simple checklist.

- Check Your Credit Report (AnnualCreditReport.com offers free reports).

- Calculate Total Debt and current APRs to know your starting point.

- Gather Proof of Income and ID documents.

- Complete Online Application accurately.

- Compare Loan Offers carefully: APR, term length, and fees.

- Read Final Agreement before signing anything.

Sources:

- Investopedia: What Is Debt Consolidation and When Is It a Good Idea? (2024-05-22)

- Experian: Pros and Cons of Debt Consolidation (2024-08-22)

- Forbes Advisor: Debt Consolidation Loan Statistics & Trends (2025-01-12)

- Bankrate: Pros and Cons of Debt Consolidation: Is it a Good Idea? (2025-08-19)

- StepChange: Debt Consolidation Loans (Date unavailable)

Conclusion

If you’re tired of chasing multiple due dates and high-interest payments, traceloans.com debt consolidation can be a real lifeline. It won’t erase your debt overnight, but it can simplify your financial life and help you move toward stability. Like Bruce McClary from the NFCC reminds us, “Getting your ducks in a row is so important.” That means knowing your credit score, reading the fine print, and choosing terms that fit your long-term goals.

For young professionals, parents, graduates, or even retirees on fixed incomes, traceloans.com debt consolidation isn’t just about money it’s about peace of mind.

FAQ’s

Does Traceloans.com do a hard inquiry?

Only after you pick a loan and proceed with the chosen lender.

What is the minimum credit score for Traceloans.com?

Most lenders look for 600+, but options exist for lower scores at higher rates.

Can I consolidate student loans with Traceloans.com?

Yes, private student loans can often be included alongside credit cards.

How long does funding take?

Typically a few business days once the offer is accepted.

Are there hidden fees?

Traceloans.com doesn’t charge fees, but lenders may include origination costs.

What if I have bad credit?

You may still qualify, but expect higher interest rates and fewer choices.

Author Bio

Marcus Ellery is a Personal Finance Writer with over 9 years of experience covering consumer credit and debt solutions, Marcus helps readers cut through complexity and make smarter money decisions.